- Startup Chai

- Posts

- 💰 IPOs, Hidden Millions, and AI Dubbing: Dive into Today's Startup Stories over a Chai 🚀

💰 IPOs, Hidden Millions, and AI Dubbing: Dive into Today's Startup Stories over a Chai 🚀

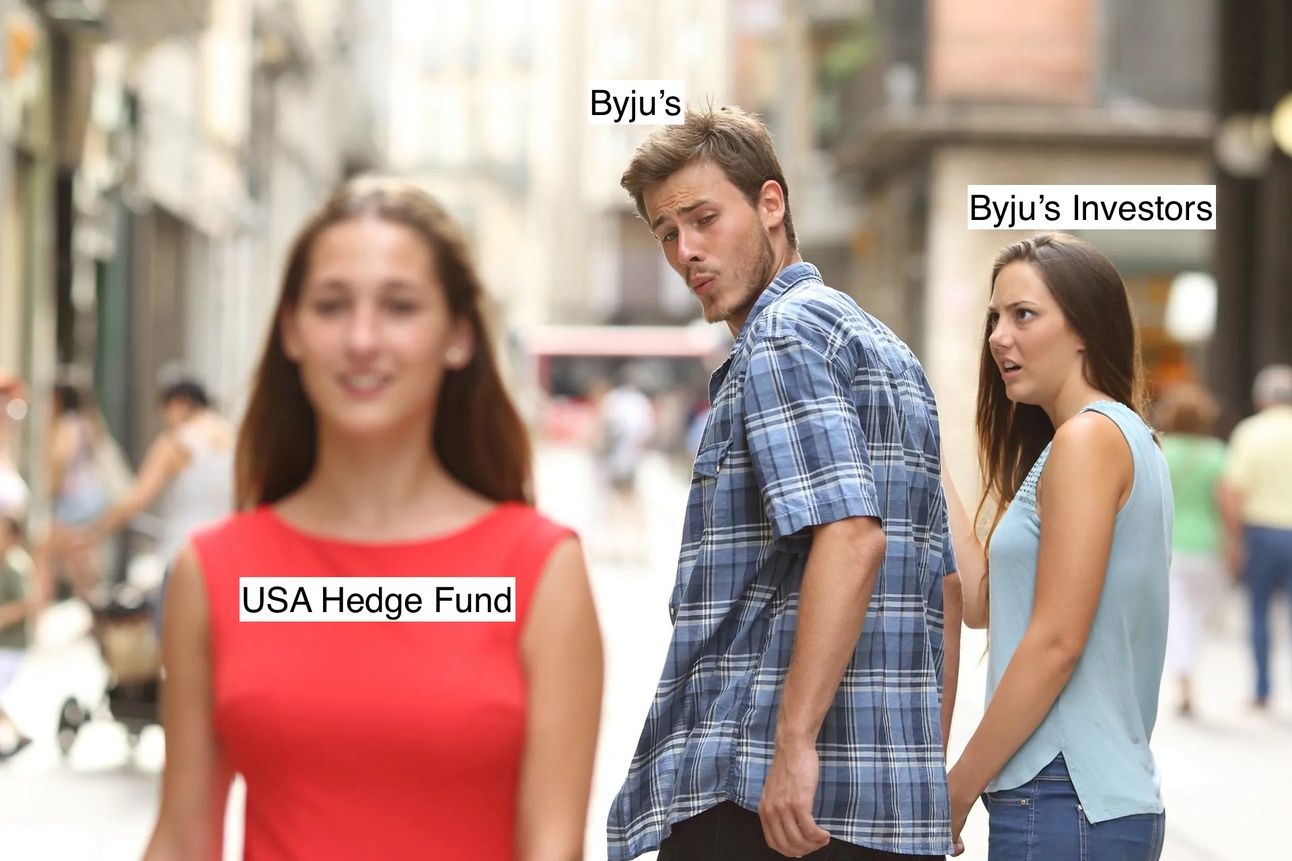

Kangali mein Aata Geela: Where in the world is Byju’s money?

In today's episode of 'Where in the World is Byju’s Money?', we find ourselves tuning into a courtroom drama that's more gripping than your average prime-time soap opera. Picture this: a small Florida hedge fund, a mysterious $533 million, and a courtroom showdown that's got more suspense than a cricket match in the final over.

Enter William C. Morton, the man of the hour, who apparently treated the hefty sum of $533 million like a hot potato, tossing it into his hedge fund, Camshaft Capital Fund, and now, possibly wishing he hadn’t. Morton was asked by Judge John Dorsey of US Bankruptcy court in Delaware for the location of the money but according to Morton’s lawyer, Morton has ‘left the country’.

Judge Dorsey set a hearing for later this month to determine Morton's punishment for disobeying a court order so this saga is likely to continue.

Read more here.

Riding the Stars: Sebi approves Go Digit's IPO launch

Looks like Go Digit is ready to blast off into the galaxy of IPOs! The folks at Go Digit General Insurance, backed by Fairfax Group of Canada, have got the green light from SEBI to launch their IPO mission.

After filing their preliminary IPO documents back in August 2022, they've finally got the thumbs up. Their IPO plans include selling off a chunk of shares worth Rs. 10.94 crore and dishing out some fresh shares worth Rs. 1,250 crore.

Read more [here](https://www.financialexpress.com/market/ipo-news-fairfax-backed-go-digit-gets-sebis-nod-to-launch-ipo-3413425/.).

The IPO market heats up: BlackBuck, a logistics firm backed by Flipkart, intends to go public and raise up to $300 million.

Hold onto your seats, because just when we thought we could finally catch our breath from all the IPO madness, here comes BlackBuck crashing the party! This B2B online trucking platform, is gearing up for its very own IPO extravaganza. They're planning a secondary sale of shares by the current investors, while also tossing in a fresh batch of shares to raise some serious cash for their truck-tastic venture.

They've got big-name clients like Reliance Petrochemicals, Hindustan Unilever, Hindustan Zinc, and Marico lining up to hop on board their trucking train.

Read more here.

Ae Bhai Zara Dekh ke Chalo: $500 million exit and founders get nothing

FanDuel was purchased by Paddy Power Betfair (now known as Flutter) in July 2018 for a cash sum of $465 million. At first glance, it appeared that the FanDuel founders and staff had won big. However, the majority of the staff at FanDuel and the company's founders gained nothing from this enormous transaction because the two principal investors had substantial liquidation preference rights.

This should act as a warning sign for desi startups. Don’t be so desperate for funding that you're willing to sign anything without even glancing at the fine print. You might just end up in a sticky situation like this one. So, read those documents carefully, folks, unless you want to be in a pickle like our friends here.

Read more here.

Fundraising and financials

The funky folks over at dubpro.ai just hit the jackpot with a cool $500,000 seed investment. These geniuses are mixing up AI and good ol' human dubbing tech to create something totally rad. And get this – it's priced at just Rs. 150 per minute! Perfect for all you reel and short addicts out there in India who just can't get enough of those language swaps.

Read more here

Kido International, that snazzy UK-based children’s nurseries powerhouse with a cool $7.5 million recent fundraise burning through its pockets, just swooped in and snatched up Amelio Early Education. Kido's been making waves over in the UK with their 14 early childhood centers. With Amelio's centers in their pocket, they're planning to take India by storm, bumping their total presence up to a total of 39 centers.

Read more here

The topline of ApnaKlub, the B2B procurement and distribution hotshot, skyrocketed sixfold Rs 278 crore. But here comes the twist – their losses ballooned to Rs 56 crore in the same period, up from a measly Rs 12 crore in FY22. On a unit level, they were shelling out a cool Rs 1.19 just to earn a single rupee in FY23. That's like paying the price of a gourmet meal just to score a measly snack!

Read more here.

Exly, a provider of a suite of tools for course and community creators, has secured $6.2 million in a fresh funding round, spearheaded by Chiratae Ventures.

Read more here

Looks like the Indian edtech sector is a rollercoaster of ups and downs. HCL just whipped out a cool $20 million and threw it at an edtech firm called Educational Initiatives, which offers fancy suite of assessment and adaptive learning goodies for teachers and students alike.

Read more here